App Review - Mileage Log+

January 21, 2014 Filed in: app review

Tweet

Tracking mileage is a tedious chore and can easily be forgotten in the daily ritual that is life. Unless your vehicle is used 100% for business then you will need to track the mileage in order to show the IRS what miles were driven for business, charitable work, medical purposes, pleasure and commuting. It is important because each of these gives you a different tax benefit:

Mileage Log+ by Contrast is one that I have been using recently and has a feature set that is robust yet the app easy to use. They tout that it is built “with IRS compliance in mind” and that is a great way of describing it.

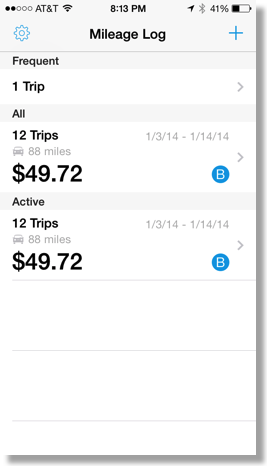

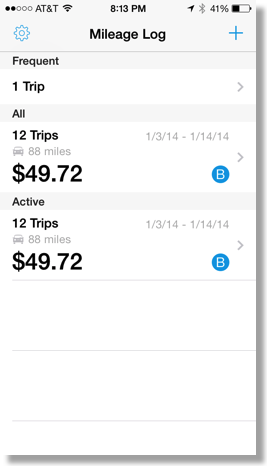

The start screen gives you a good overview of your recent trips. Access to settings is at the top left and adding a new trip is as easy as tapping the + sign in the top right. If you have frequent trips to from and to the same place there is a place to add those after you have entered the first one on the individual “trip” screens. You then have quick access to select a trip and add it to your log.

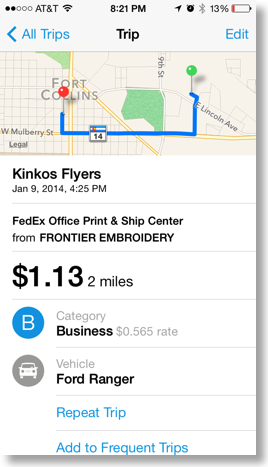

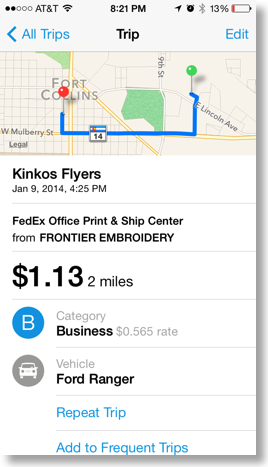

The Individual trip screen show how much mileage and deduction each trip accumulated. It also has a very nice built in search function for business and addresses. When you start typing it suggests locations. That is very useful even if it is at the mercy of apple maps.

Every month you can export the data in PDF or CSV format for easy tracking in a spreadsheet. This makes year end accounting easy. When you export, the reports are very easy to use and formatted with use for your accountant in mind. For an example click here.

There are a few issues that I think could be addressed in version 2

- There is not a way to separate the “expenses” portion of the PDF report. It lumps everything together and makes it difficult to calculate parking fees or incidental expenses. You can use the CSV format to break out the data, but then you lose the nice formatting.

- There is no way to use an alternate route when using the map function. You are stuck with the shortest route, which might not necessarily be the route you traveled.

- Having a way to enter your starting odometer reading for the starting and ending of the month or year would allow a good way to track overall mileage. Currently this is not supported in Mileage Log +.

Overall this is a great app that is polished and very intuitive to use. It will make your accountant or bookkeeper wonder how you made such a professional report and save the small business owner or employee the trouble of totaling their mileage every month.

Overview

Tracking mileage is a tedious chore and can easily be forgotten in the daily ritual that is life. Unless your vehicle is used 100% for business then you will need to track the mileage in order to show the IRS what miles were driven for business, charitable work, medical purposes, pleasure and commuting. It is important because each of these gives you a different tax benefit:

- 56.5 cents per mile for business miles driven.

- 24 cents per mile for medical or moving purposes.

- 14 cents per mile driven in service of charitable organizations.

Mileage Log+ by Contrast is one that I have been using recently and has a feature set that is robust yet the app easy to use. They tout that it is built “with IRS compliance in mind” and that is a great way of describing it.

Pros

The start screen gives you a good overview of your recent trips. Access to settings is at the top left and adding a new trip is as easy as tapping the + sign in the top right. If you have frequent trips to from and to the same place there is a place to add those after you have entered the first one on the individual “trip” screens. You then have quick access to select a trip and add it to your log.

The Individual trip screen show how much mileage and deduction each trip accumulated. It also has a very nice built in search function for business and addresses. When you start typing it suggests locations. That is very useful even if it is at the mercy of apple maps.

Every month you can export the data in PDF or CSV format for easy tracking in a spreadsheet. This makes year end accounting easy. When you export, the reports are very easy to use and formatted with use for your accountant in mind. For an example click here.

Cons

There are a few issues that I think could be addressed in version 2

- There is not a way to separate the “expenses” portion of the PDF report. It lumps everything together and makes it difficult to calculate parking fees or incidental expenses. You can use the CSV format to break out the data, but then you lose the nice formatting.

- There is no way to use an alternate route when using the map function. You are stuck with the shortest route, which might not necessarily be the route you traveled.

- Having a way to enter your starting odometer reading for the starting and ending of the month or year would allow a good way to track overall mileage. Currently this is not supported in Mileage Log +.

Conclusion

Overall this is a great app that is polished and very intuitive to use. It will make your accountant or bookkeeper wonder how you made such a professional report and save the small business owner or employee the trouble of totaling their mileage every month.

blog comments powered by Disqus